Risk Management

For Capital Companies

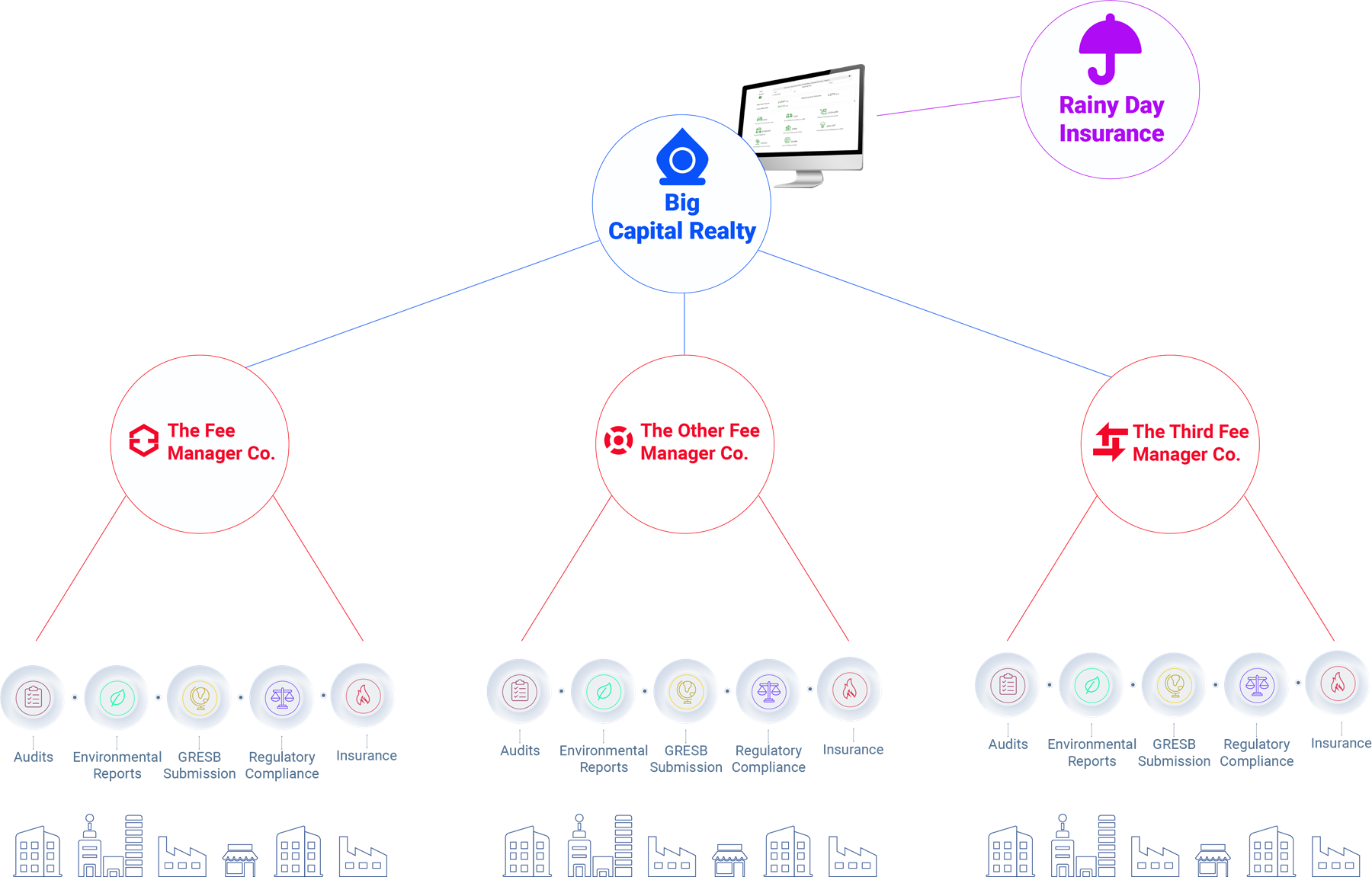

Your Birds-Eye-View of Governance, Risk and Compliance

Quickly identify missing documents at each site to manage compliance with confidence and clarity. Instantly provide stakeholders with the latest reports, audits and surveys at the click of a button.

MANAGE EXPOSURE

ACCELERATE REPORTING

ENHANCE YOUR BRAND

How it works for Capital Companies

With everyone connected on one platform you can see how sites and fee managers are performing.

Quickly assemble documents for relevant stakeholders

With everyone on one system, site documents or reports uploaded from your consultants and vendors are instantly available to anyone in your company.

Build custom surveys in a snap

You can take the temperature on any issue at your sites or portfolios using Refined Data’s survey builder tool, You can use or modify existing templates or you can build surveys from scratch. Either way, it’s dead simple to use and is packed with powerful features you will love.

EXAMPLE:

Make insurance renewal simple.

Dashboards show any site that is missing vital assessment reports in real-time. Pull together all the reports your insurer needs for renewals in hours rather than months.

1 – FEE MANAGERS: Manage operational risk, including retaining consultants to complete periodic Phase I and II Site Assessments using Refined Data.

2 – CONSULTANTS: Consultants can submit reports directly into the Refined Data system using secure authentication.

3 – INSURERS: Provide a secure view of specific reports for specific sites OR package the reports to a thumb drive at the click of a button for physical delivery to your insurer.

Manage risk from acquisition to disposition

Build resiliency in your portfolio. Reduce the cost of managing risk, create efficiencies, save time, and prevent errors with a unified platform.

PROTECT: Having everyone connected on a single platform that is agile and responsive is the best protection to the complex and interdependent risks you face. No more siloed applications or Excel Hell.

DETECT: You get a birds-eye view into what’s happening in real-time at each site and across your portfolio. I identify underperforming sites or underperforming regions in your portfolio.

CORRECT: You know right away when the unexpected occurs, so the issue or risk gets mitigated quickly and appropriately. Protect your downside and ensure no more nasty surprises.